It is our mission at Lifelaunch Consulting to help others define their ‘next’ with purpose and intention, and to celebrate as a new chapter unfolds. As part of this, we are highlighting our friends who have successfully navigated the move from ‘now’ to ‘next’ and are thriving as a result! It is our hope that by sharing these stories, we inspire others to live their lives to the fullest.

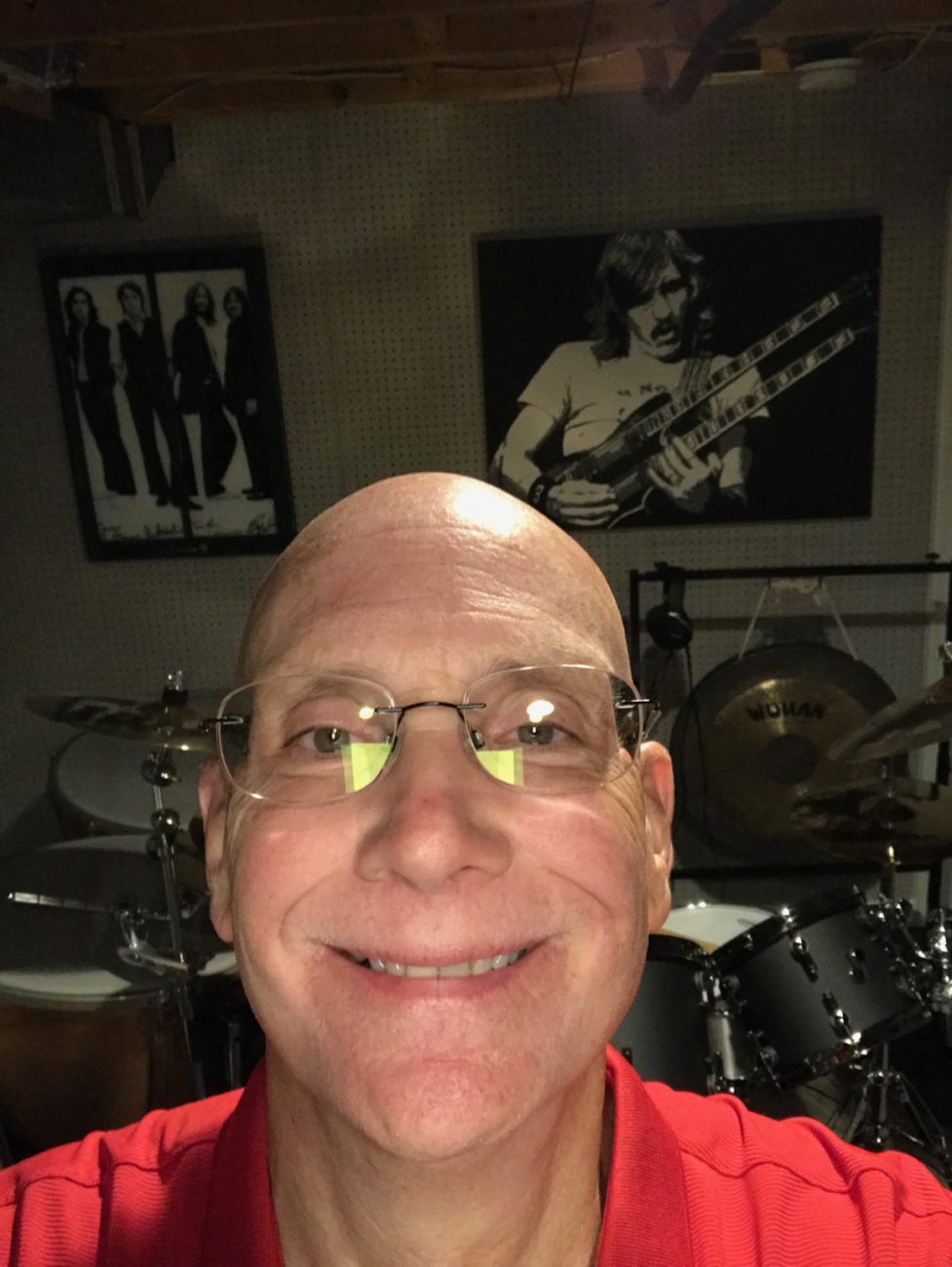

Name:

Larry Lewellen

My pre-retirement career:

14 years as VPHR for Ohio State University (CHRO for the university and all entities); 5 years as VP Health Innovation for the OSU Medical Center.

Three ways I spend my time in my ‘next’ chapter:

(I have included four!)

– As a member of the Registry, a Massachusetts company which deploys previous university executives as interim university leaders upon request. The interim leader assignments are as independent contractor/consultant status to make difficult changes, bring new ideas, and truly be independent; bringing a seasoned executive in from outside to fill interim needs is a quickly growing trend in higher education.

– As a principal of Optimized Care Network, a digital health care company bringing high-immersion 3-D telehealth clinics to senior living centers, employer campuses, and population health based solutions for multi-employer industries; I primarily do business development with employer as well as leveraging contacts in health care systems, payer and broker firms to form partnership-based strategies.

– Home renovations, doing major renovation of large bathrooms upstairs and building a room addition on the back of the house. I have a 1 person part-time contractor working with me, and we share the work

– I’m a hard core cyclist (bicycles) and love to ride in organized charity rides and to organize training rides for interested cyclists in the New Albany area. Cycling has become a major networking activity, a huge social connector and a social “equalizer”–on rides, there are CEOs, college students, people of all occupations and levels, all riding together without distinction of class or status. Very awesome!!

What I love most about retirement:

I love two things the most:

1. Flexibility—flexibility of time, of choices, of commitment level–if you stay in control (its easy to get out of control!!), you can make significant contribution but dispense with the old structures of 8-5 hours or needing to be “in on everything”. Its tempting when getting involved with an activity to agree to be in on every meeting, follow every chain of emails; if you can decide where and how you want to contribute and stay true to that, you can be effective and still have a flexible life.

2. Constructive intolerance–when involved in consulting assignments, business development, charity activities, at this stage of life there is even much more freedom to be intolerant of silly rules, lack of honesty, self-serving agendas, and even of mediocrity. I believe this provides an even clearer role model for those still within active careers, and helps teach organizations that senior talent and millennial talent have the same expectations and together will reform the work environment.

My biggest challenge with retirement:

My biggest frustration is with the label of “retirement”! Even though I am quite involved with leadership consulting assignments, healthcare business development, and other involvements, I have people ask me “how does it feel to be retired?” My usual answer is “If I understand what you mean by the word ‘retirement’, I’ll let you know when I get there! I am admittedly over-sensitive to that question!

What I did to prepare for retirement:

I had a long career in Human Resources, but a friend helped me understand that I should work on developing some interest or capability while in my career that would become my focus in retirement. I evaluated quite a few options, but eventually settled on the fact that health is my greatest passion, and would want to work in the field of health, wellness and healthcare (a continuum) when I move to retirement. I shared this with a couple of very close colleagues and inappropriately….but luckily….one of them leaked my intentions to the CEO of the Medical Center. He called me over for a meeting, told me what he’d heard, and asked if I would come work for him to (my paraphrasing) help push innovation as a top-line growth strategy for the medical center. I accepted, and that experience has done wonders for my ability to pursue health ventures in retirement.

Something I’ve recently done for the first time:

I did my first interim leadership consulting assignment in 2016-2017 as interim VPHR of the University of Maine. I had never been in the New England area at all, the opportunities for biking, hiking and motorcycling were unbelievable!!! But, this was my first time of walking into a university of leaders I had never met, and inspiring them to adopt a leadership initiative to improve their individual and collective leadership abilities. The University of Maine is led by the most amazing, experienced, values-centered group of leaders I have ever met. The fact that I could help them think more deeply about leadership aspirations and the never-ending journey of learning and development at any level, was an extremely fulfilling time for me.

Most recent book/article I’ve read:

I have read this before, but recently re-read the book: The Advantage, by Patrick Lencioni. I love all of his books, but this one focuses on the tremendous value of Organizational Health….not necessarily meaning the individual wellness form of health, but rather organizational health which includes key factors such as clarity, cohesion of leadership, just the right amount of structure, etc. Lack of clarity from top to bottom and division to division, feuding leaders and bureaucracies are heavy anchors on the path to success.

My future:

My wife and I have committed to continue our ventures in 2018, and then to “unhook” for the year of 2019 and travel across the country, possibly in an RV, with our bicycles. Years ago I rode my bicycle down the west coast and she accompanied me in an RV. That was a tremendous experience for us as a couple and we want to build on that experience and try unhooking from professional ventures for a year. We will then decide what the next year will be at that time, taking it a year at a time!!!!

My advice for those preparing for the transition from ‘now’ to ‘next’:

a. Prepare in advance, so that you can develop some expertise, skills, connections in the venture you will want in retirement. If honest with ourselves, our retirement passion often may be an area that is unrelated to our current career and life experience; plan ahead to develop involvement in that passion!!

b. Have a plan that is directional and tangible, but not too detailed. You should remain open to new discoveries, connections, experiences, rather than be overly tied to working a plan.

c. Prepare for a potentially closer and deeper relationship with your spouse or life partner…..relationships can become somewhat superficial by necessity when both are challenged to the hilt by career and family, and “going deep” again can be exciting or scary, or both!